Tues: 8:30am - 3:00pm

Wed: 12:00pm - 6:00pm

Thurs: 8:30am - 3:00pm

Fri: Closed

Sat: 8:30am - 12:30pm

Sun: Closed

Greenvale, NY 11548

Be Smart with your Health Insurance Deductible Before the New Year

With Thanksgiving on the horizon and December holidays just around the corner, our to-do lists are filling up fast. Is a dermatology checkup on that list?

Here’s why it’s a great idea to take care of your healthcare needs before the clock runs out on the current year: Most insurance plans run from one calendar year to the next. This means the amount you paid towards the deductible on your plan will reset to zero on January 1. If you have reached, or are close to reaching your deductible, now is the time to get a dermatology appointment on the calendar before the New Year.

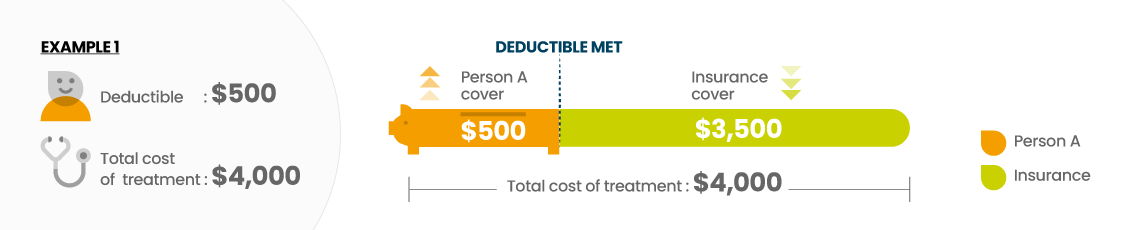

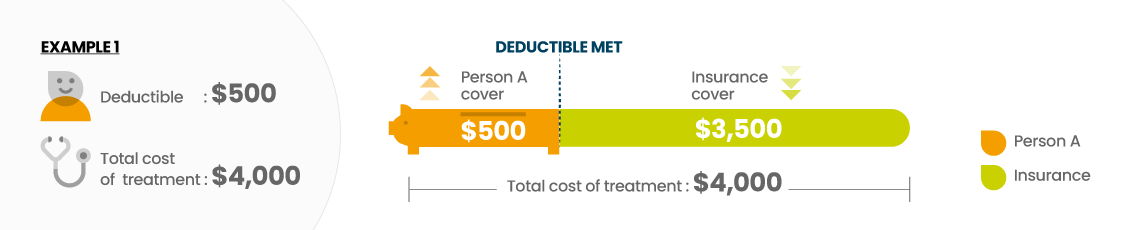

Your deductible is the amount you pay for covered health care services before your insurance plan activates and covers the cost. Every plan is different, so your best bet is to review your policy and check your statements to see where you stand.

Deductibles Aren’t Getting Any Smaller

Patients often have to meet a hefty deductible during the year before their policy takes over. The average deductible is now more than $1,600 per year, according to the Kaiser Family Foundation. Once you hit that out-of-pocket threshold, your insurance finally kicks in and starts paying. But the clock starts all over again on January 1.

So if you have crossed that line or you are getting close, now is the best time to take care of yourself.

Schedule that dermatology checkup you’ve been putting off all year. Whether it’s a mole or discoloration on your skin that’s been worrisome, or maybe you just need a checkup for an existing condition, if you’ve reached your deductible, chances are you won’t face any out-of-pocket expenses for these year-end visits. Perhaps you need to see a dermatologist only once a year. Why not let your insurance company pay for the visit? Bottom line, you’ll save money. That’s a holiday gift both to you and your family.

On the other hand, if you are not close to meeting your deductible before December 31 it might make more sense to delay non-critical health care expenses until after January 1. That’s because if you spend your money now on a checkup that could be done early next year, those dollars won’t count toward your deductible when it resets on New Year’s Day. With good planning and timing, you can maximize the value of your out-of-pocket health care dollars while taking care of yourself.

Be Careful Before Switching Plans

Some folks find that year after year they never quite meet their deductible. This can create the temptation to look for a plan with a lower deductible. Before you make a switch, know that premiums for lower-deductible plans are often higher than you would end up saving with insurance once you hit the deductible on your current plan.

Check your policy or contact the administrator of the plan so you know to a certainty what’s covered – and how much. The good news is, in most cases qualified preventative services are already covered at 100% so you won’t have to pay anything out-of-pocket.

Getting the Best Care

At Walk-in Dermatology, our board-certified dermatologists are ready to help. Whether you schedule an in-person or virtual visit, you can be seen long before the clock runs out on this year’s insurance deductible. Keeping more money in your pocket means happier holidays. Schedule your appointment today.